Everything about Residual Income Valuation Mode

One of the most popular options for valuing businesses is The Residual Income Model or the residual income valuation model. Very simple, this model assumes that the value of the company is equals to present value of all future residual income and discounted at the cost of equity. In comparison to the other methods such as asset or earning base methods, this method can be a more accurate way to value a company. Through this article, we will talk and explain about the residual income valuation model and how we can utilize this to value your business.

What is Residual Income Valuation?

The word residual income means the owner or founder has the free cash flow available after all the expenses has been paid off and this residual income valuation model is based on the concept of “residual income.” So in general term, this residual income model values a company based on the ability to generate the revenue and cash flow after all the expenses has been paid.

In other words, this residual income is the company’s income adjusted for the cost of equity. The cost of equity is essentially the required rate of return asked by investors as compensation for the opportunity cost and corresponding level of risk. Therefore, the value of a company calculated using the residual income valuation is generally more accurate since it is based on the economic profits of a company. Major businesses prefer this residual income valuation model because it is very easy and simple to use.

Not just the past performance, this model takes into account the eligibility and ability of company to generate the future cash flow.

Benefits and Limitations of the Residual Income Model

Every coin has two side and The Residual Income Valuation Method also has some advantages and limitations of its own as compared to the more popular and more used methods such as Dividend Discount Model and Discounted Cash Flows (DCF) model.

Let’s talk about some of the benefits of the Residual Income Valuation Model:

- Compare to other methods, this model is very simple and easy to evaluate and

- Compared to other methods such as asset-based method and earning-based method, Residual Income method is accurate in terms of

- Company’s future income is essential in any investment decisions and this method consider the residual income of company which is why this is beneficial for the

- This method can be used for value company’s valuation with different capital structures and

/ or in various stages of business life cycle.

Now, let’s talk about the other side, The limitations of the Residual Income Valuation Model:

- This method does not include or consider the time value of

- It does not define but assumes that the company re-invest all the income or residual income at the cost of its

- Capital options such as debt or preferred stock does not considered with this

- It is hard and challenging to estimate the company’s future endeavours and performance and this model majorly relies on future

Despite having its fair share of down points, this residua income valuation model is helpful and considered in valuing companies.

When it’s advisable to use the Residual Income Model

For the companies which does not pay dividends or generate any negative free cash flows, they can prefer and they are advised to use Residual Income Valuation model.

For the companies or entities who pay dividend, they can prefer DDM which is Dividend Discount Model. On the other hand, entities who generates free cash flow and not paying dividend can prefer Discounted cash flow model for the valuation.

How to calculate Valuation of a Company with Residual Income Model

To calculate the company valuation using the residual income valuation model, you need to first estimate the future residual incomes and then discount them with the cost of equity.

Residual future income is the difference between the net income and equity charge. In simple words, Residual Income can be calculated by subtracting the Equity charge from the net income of the company.

So, the equity charge is a multiple of the company’s equity capital and cost of equity capital. The first step will be to calculate equity charge.

Equity Charge = Equity Capital * Cost of Equity / the required rate of return for the equity investors

Now, we have the Equity charge calculated, we can have the residual income by subtracting the Equity charge from net income of the company.

Residual Income (RI) = Net Income (NI) – Equity Charge

Now, as we have residual income calculated, we can now calculate the company’s present value as the sum of all residual incomes in perpetuity, discounted at the cost of equity rate. In other words, the estimated or worth value of a share of common stock is the sum of book value per share and the present value of expected future per-share residual income.

We can consider the following formula for the calculation:

- Where BV = Current book value of Equity

- t = Current period

- r = cost of equity or the discounted rate

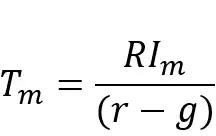

Usually or commonly, “Constant Growth” reflected in the maturity of the company and we assume that every company achieves the maturity at some point. Then, we calculate the corresponding Terminal Value from the year the constant growth is assumed to start for calculating the RI Valuation.

- Where,

- m = first period after the projected periods

- g = expected stable growth rate

The final valuation formula adjusts the previous multi-period formula by adding a continuing value (similar to terminal value) which incorporates a persistence factor. The persistence factor attempts to capture competitive forces which will drive return on equity down towards cost of equity capital over the long-term as new entrants will look to compete in any market that offers high returns.

The final RI valuation can be calculated as:

The Residual Income valuation model is valuable and effective tool or method for the companies which are expected to have a successful growth in future. This model focusing on the company’s ability and strength to generate free cash flow. Start-ups usually choose this method for the valuation as they don’t have historical or past data.

Conclusion

For valuing Business, the residual income valuation model is getting popular day by day and is effective for the start-ups majorly. For any analyst, it is one of the musts to have in their tool kit. As described in the article, like any other valuation method, residual income valuation model has its advantages and limitations. It is advisable to use another valuation method parallel to residual income method to get effective, assure and accurate estimated valuation of your business.

For more in-depth knowledge and help about the valuation methods of your business and guidance on the valuation of your start-up or business, contact us now.

Visit our site to learn more about our valuation services and other aspect of start-up valuation: https://myvaluation.in