409A Valuation Services in India

In the competitive Indian startup landscape, attracting and retaining top talent is a challenge. Stock options and other equity-based compensation are powerful tools for this purpose. However, it can’t be done without 409A valuation.

A 409A valuation is an independent assessment that determines the fair market value (FMV) of a private company's common stock. This valuation is crucial for Indian startups offering stock options or other equity-based compensation to employees.

My Valuation is a top 409A valuation service provider in India. We understand the nuances of the Indian startup ecosystem, ensuring the valuation methods used are relevant to your company’s stage and industry.

Staying updated on the latest regulations impacting Indian startups and 409A valuations, we guarantee your report adheres to all requirements.

What is 409A Valuation?

A 409A valuation is a crucial financial assessment conducted to determine the fair market value (FMV) of a company's common stock. This valuation process is mandated by Internal Revenue Code Section 409A, which governs the taxation of nonqualified deferred compensation such as stock options and other forms of equity-based compensation.

The primary purpose of a 409A valuation is to establish a fair and defensible FMV of the company's stock, which is used to set the exercise price of stock options issued to employees or other service providers.

Typically, 409A fair valuations are performed by independent third-party valuation experts who employ recognized valuation methodologies. These methodologies may include the income approach, market approach, and asset-based approach.

The choice of methodology depends on the nature of the company, its industry, and available data. Valuation experts consider various factors such as the company's financial performance, market conditions, comparable transactions, and future prospects to arrive at a reasonable FMV.

How Important is a 409A Valuation?

A 409A valuation for startups is highly important to issue stock options or other forms of equity-based compensation to their employees or service providers.

A 409A valuation holds substantial importance for private companies for several key reasons:

Get Accurate 409A Valuation Services

When Should a Startup Get 409A Valuation?

Startups should consider obtaining a 409A valuation under several circumstances, primarily related to issuing stock options or other forms of equity-based compensation to employees or service providers.

Key Scenarios:

When is 409A Valuation Required for an Indian Company?

Just like you wouldn't sell a table without a price tag, companies shouldn't offer equity (ownership stake) to employees without knowing its value. A 409A valuation helps determine this fair market value. Here's when Indian companies need one:

The IRS generally considers a recent 409A valuation (within 12 months) with no significant changes between the valuation and grant date as reasonable. However, if these conditions are met, the IRS bears the burden to prove a valuation as "grossly unjustified."

Stock Options and Equity Compensation: Important US Tax Considerations

Early Tax Payment Option (83(b) Election):

Tax-Advantaged Stock Options (ISOs):

Reporting Employee Stock Activity (Forms 3921 & 3922):

Valuation for Private Companies (Section 409A):

Accounting for Stock Compensation (ASC 718):

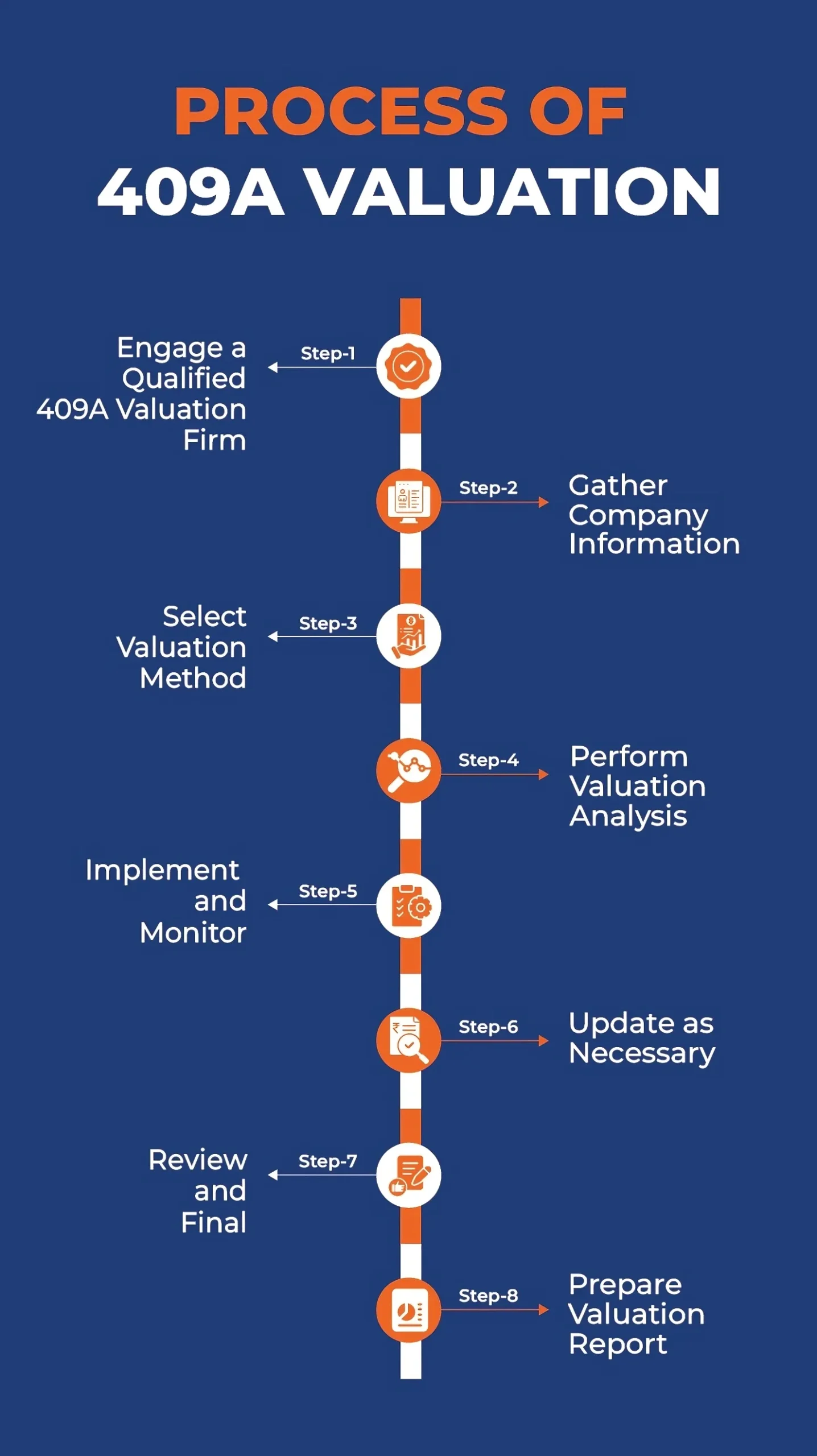

Process of 409A Valuation

Documents Required for 409A Valuation

To determine a fair price for your company's stock, the appraiser will ask for some documents:

Exit Strategy:

Knowing your expected timeline for potential acquisitions or IPOs helps assess the stock's liquidity.

Growth Plans:

Sharing your estimated number of stock options to be issued based on hiring projections helps the appraiser understand future dilution.

Financial Fitness:

Recent financial statements (profit and loss statements, bank statements) and a capitalization table will provide a snapshot of your company's financial health.

Investment Story (if applicable):

If you've received investments, include the share purchase agreement for context.

Company Developments:

Highlight any major events since the last valuation that could affect the stock price.

Company Background:

Articles of incorporation will show your legal foundation.

Why Choose My Valuation for 409A Valuation Services?

My Valuation provides standardized 409A valuation services in India. With My Valuation, you get independent third-party company valuation for IRS 409A. Our professionals with their extensive knowledge use specific valuation methods, your business’ finance plans, history, projections, and other data to determine fair market value.

Get in Touch With Us For 409A Valuation

Fill up Your Contact Details and Our Expert Team will Reach to You Soon.

FAQs and Insights

A 409A valuation is an independent assessment of the fair market value (FMV) of a private company's common stock. It's named after Section 409A of the Internal Revenue Code in the US.

Appraisers consider various factors like financial health, future plans, industry benchmarks, and investment history to determine the FMV of the company's stock. This fair market value is then used to set the exercise price for stock options granted to employees.

Indian companies typically don't need a 409A valuation since it's a US tax regulation. However, if an Indian company has US employees holding stock options or plans to raise funds from US investors, a 409A valuation might be advisable to ensure compliance with US tax regulations for those employees or investors.

US tax considerations are important because they can impact the tax treatment of stock options for US employees or US investors in the company. A 409A valuation helps ensure the company complies with these regulations and avoids potential tax issues.

There are several reasons a company might need a 409A valuation: To set a fair exercise price for stock options offered to employees (helps attract and retain talent), comply with US tax regulations if the company has US employees or investors with stock options, and secure funding from investors who may require a 409A valuation as part of the due diligence process.

The company typically works with a qualified valuation firm. The appraiser will request various documents about the company's financials, plans, and milestones. They will then analyze this information and compare companies to determine the fair market value.

The timeframe can vary depending on the complexity of the company and the availability of information. It usually takes 2-4 weeks, but it could be shorter or longer depending on the specific circumstances.

There's no one-size-fits-all answer, but early-stage startups should consider a 409A valuation before granting stock options to employees or raising funds from investors. It helps establish a baseline value and avoids potential issues down the road.