SEBI Registered Merchant Banker | Business Valuation

My Valuation is a reputable provider of Merchant and Investment banking services, offering a comprehensive range of solutions for both Equity and Debt markets. Our extensive services include Valuations, Private Placement of Shares, Compulsory Convertible Debts/ Bond Issuances, Fundraising through Convertibles Notes, SAFE (Simple Agreement for Future Equity), Mergers and Acquisitions Advisory, ESOP Advisory, and Corporate and Transaction Advisory services.

Key Services

Valuation under Income Tax Act

- Valuation for issue of shares / securities to resident or non-resident

- Valuation on sell of shares / securities to resident or non-resident

- Valuation under section 56 of Income Tax Act, 1961

Valuations for Stock Incentive Plans

- For grant of stock options / ESOP

- For sell of stock options

- Valuation for perquisite purpose

- Valuation of Option by Black & Scholes Model

- Valuation of Option by Binomial Pricing Model

- Sweat Equity Valuation

Valuation under RBI and FEMA

- Valuation of Shares for Inward remittance

- Valuation of Shares for Outward remittance

- Other RBI Related Valuations

- Other FEMA Related Valuations

Business Valuations

- Restructuring / Merger / Demerger

- Fairness Opinion

- Acquisitions / Disposal

- Valuation of securities of unlisted companies

- Convertible Instrument Valuation

- Fundraising / private placement

- Discounted Cash Flow (DCF) Valuation

Intellectual Property Valuations

- Goodwill / asset impairment testing

- Brand valuation

- IPR valuation

Ind AS Valuation

- Share Based Payments – Ind AS 102 (ESOP – both cash and equity settled).

- Business Combinations – Ind AS 103

- Financial Instruments – Ind AS 109

- Intangible Assets – Ind AS 38

- Property, Plant and Equipments – Ind AS 16

- Impairment of Assets – Ind AS 36

- Investment Property – Ind AS 40

Our Approach

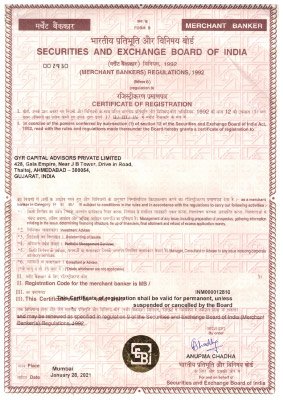

Certification for Registered Merchant Bankers

Let’s discuss about how we can help make your business better

[contact-form-7 id="" title="SEBI Registered Merchant Banker"]